Do you remember when you were in school and the teacher would give each student a worksheet to “spot the difference” between two side-by-side detailed scenes? You would look carefully at each of the two images, trying to spot subtle details, such as an extra button on a shirt or a missing shoe on a person. Maybe it was the number of petals on a daisy or a cone of ice cream missing the cherry on top. The directions would indicate there would be six differences, but try as hard as you did, (and even when you asked a classmate for help) you could still only find four or five differences, and were convinced there was never a sixth.

Why You Will Not Receive a Tax Refund Before February 15

Barbara Theofilos, CPA, MBA fraud , Barbara Theofilos , Taxes - Individual , income taxOn December 18, 2015, President Obama signed legislation called “Protecting Americans from Tax Hikes” Act of 2015, or the PATH Act for short.

The PATH Act contained many extensions and changes to existing tax laws. The Act also included a provision which will delay refunds for certain taxpayers. The IRS is now required to not issue a refund to anyone claiming the Earned Income Tax Credit or the Additional Child Tax Credit until February 15. Both of these refunds are considered “refundable credits,” which are essentially treated as additional tax payments, and can reduce one’s tax liability below zero. More, the PATH Act was enacted to give the IRS more time to review refund claims, in an effort to reduce fraud and catch refunds that may be improperly issued.

Do you have questions about the PATH Act, your refund, or income tax preparation? Let's talk! Contact me at btheofilos@zinnerco.com or any of the professionals here at 216.831.0733. We're ready to start the conversation and end the confusion.

Federal, state and local authorities have indicted dozens of people and businesses in the U.S. and India accused of impersonating Internal Revenue Service employees demanding money from innocent taxpayers in the U.S.

Related: Follow our Fraud & Scam blogs

Confronting the latest scheme to target taxpayers, the IRS and its Security Summit partners warned (on September 22, 2016) that scammers have sent fake emails purportedly containing CP2000 notices, which are used in the IRS’s Automated Underreporter Program.

Read more about IRS Scams by Howard Kass

The IRS emphasized that it never sends these notices by email, and instead uses the U.S. Postal Service (IR-2016-123).

Have you been notified by the IRS? You may want to think twice before responding to the call, email or letter.

The work of criminals knows no boundaries. Unfortunatley, this time of year brings another wave of antics to the forefront as the criminal will use various ploys to trick taxpayers into providing sensitive or personal identification information by posing as the IRS.

Aggressive and threatening phone calls by criminals impersonating IRS agents remain a major threat to taxpayers, but now the IRS is receiving new reports of scammers calling under the guise of verifying tax return information over the phone.

IRS Scammers Demand Tax Payments on Gift Cards | Accounting Today News

The following article, written by Michael Cohn, first appeared on AccountingToday.com on May 27, 2016

The Internal Revenue Service issued a new warning Friday (May 27, 2016) to taxpayers about bogus phone calls from IRS impersonators demanding payment for a non-existent tax that they call the “federal student tax.”

The House passed bipartisan legislation May 16, 2016, to prevent taxpayer identity theft and help victims whose tax refunds have been stolen by identity thieves.

The bill was co-sponsored by a CPA turned lawmaker whose own identity was stolen last tax season.

H.R. 3832, Stolen Identity Refund Fraud Prevention Act of 2016, would establish a centralized point of contact at IRS for ID theft victims; improve taxpayer notification of suspected identity theft; require the Internal Revenue Service to submit a study on the feasibility of establishing a program for victims of identity theft-related tax fraud to opt out of electronic filing; and establish an Information Sharing and Analysis Center to collect, analyze, and share actionable data and information to detect and prevent identity theft. Two core components of the bill were enacted last December and the rest were passed Monday.

The bill was sponsored by Rep. Jim Renacci, R-Ohio, and John Lewis, D-Ga., the ranking Democrat on the House Ways and Means Oversight Subcommittee. Renacci is a CPA who also fell victim to identity theft.

Free e-book: Tax Return Fraud and Identity Theft: What to do if Your Identity is Stolen

“Today, the House passed my bipartisan bill to protect hardworking American taxpayers,” Renacci said in a statement Monday. “Tax-related identity theft is an evolving criminal activity that can happen to anyone. In fact, last tax season my identity was stolen and used to file a fraudulent tax return.”

The Ways and Means Committee passed the bill late last month (see House Committee Passes IRS Legislation on Identity Theft, Missing Children and Tax-Exempt Donors).

“We must do all we can to fight identity theft, return theft, fraud and scams,” said Lewis. “In the last few years, the Taxpayer Advocate staff assisting my constituents in Atlanta, and the caseworkers working in my District Office have seen an alarming increase in scams targeting the American taxpayer. H.R. 3832 responds to the real needs of real people. The Stolen Identity Refund Fraud Prevention Act of 2016 is a good, bipartisan and timely legislative step in the right direction.”

The bill now moves to the Senate. "I look forward to working with my Senate colleagues to ensure this bill is signed into law,” Renacci said.

“Every year, people across the country discover they are a victim of tax-related identity theft,” said Ways and Means Committee chairman Kevin Brady, R-Texas. “Congressman Jim Renacci turned his personal experience as a victim of identity theft into a legislative solution that will help protect all Americans. The bill we passed today will prevent fraud, increase transparency, and improve IRS customer service to better serve taxpayers. I appreciate Congressman Renacci’s leadership against a crime that impacts so many Americans.”

You have read security warnings advising you to stay away from particular websites and of course, not to click on the link to become the beneficiary of a far-away royal.

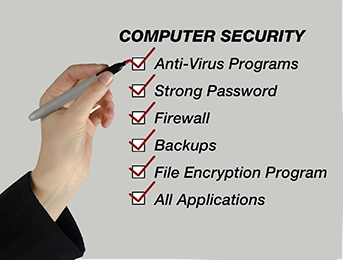

You know not to download free apps, to stay clear of file sharing, and are current with anti-virus and firewall protection. Rightfully and confidently, you feel good about the protective steps you have taken to reduce your risk of identity theft. Then - WHAM! Along comes a hacker who successfully infiltrates some of the largest technology companies in the world and as a result, steals your email password.

Related read: Classic Hackers: What War Games taught us about technology in the workplace

I recently read the following news on Forbes.com:

ax-Related Identity Theft

First of a three part series

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (51)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Charitable Donations (1)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (17)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (1)

- Digital Tax Payment (3)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (3)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (3)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (34)

- income (1)

- income tax (58)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (91)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- OATC (1)

- OBBB (3)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio Accounting Talent Coalition (1)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (4)

- Ohio Department of Taxation (7)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Ohio Society of Certified Public Accountants (1)

- One Big Beautiful Bill (5)

- Online Tax Payment (4)

- Operations (2)

- OPERS (1)

- OSCPA (1)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (53)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (14)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (105)

- Taxes - Individual (122)

- Taxes - Planning, Rules and Returns (194)

- TechCred (1)

- technology (8)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- Unemployment Insurance (1)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (35)

- Zinner News (32)