Zinner & Co. Named Exclusive Partner in Northeastern Ohio; Only One of Five Firms in the State

Zinner & Co. Named OSCPA Platinum Partner

Zinner & Co. accounting , management advisory , Taxes - Planning, Rules and ReturnsDo Your Bank Accounts Qualify for FDIC Coverage?

Zinner & Co. financial planning , banks , FDIC coverage

In our society, people tend to take the safety of their bank accounts pretty much for granted. If you think back to the most recent banking crisis in 2008 and 2009, however, there was a significant amount of bank consolidation that could have potentially resulted in depositors losing money. This leads to the question, exactly what is covered under the Federal Deposit Insurance program and do your bank accounts qualify for FDIC coverage?

By Zinner & Co.

Tax Services Department

Move South to Retire? Your Old Residence Could Still Tax You!

Zinner & Co. gift tax , Taxes - Planning, Rules and Returns , Business - Management, Issues & Concerns , Estates, Gifts & TrustsBy the Tax Services Department

You’ve finally made the decision to become one of “those people.” You know, the person who, as was drawing closer to retirement (and coincidently, during one of the never-ending sub-zero days of winter), decided that living somewhere south of the Mason-Dixon line just made sense. You meticulously planned to move south to retire. But, before you settle back in the lounge chair twirling the paper umbrella as it shades your Pina Colada, you may want to ensure you have all of your assets in order.

Not the “Gift” Development Officers Seek: The change that will affect all non-profit reporting

Zinner & Co. FASB , Audit and Assurance Department , non-profit reportingBy Carl Blankschaen, CPA

Audit and Assurance Senior

If you are one of the countless professionals serving a non-profit institution, you have no doubt heard the buzz surrounding financial reporting and how all non-profit organizations will now have to make an adjustment in the way in which they report.

The Financial Accounting Standards Board (FASB) recently issued their exposure draft on Presentation of Financial Statements for Not-for-Profit Entities. This exposure draft will make drastic changes to the financial statements of all Non-Profit organizations, and will consequently require changes in the recording of accounting information throughout the year in order to prepare the financial statements at the end of the year. What does all this industry talk mean for your non-profit?

Reducing Gift Tax for Private or Family Owned Businesses

Zinner & Co. gift tax , Taxes - Planning, Rules and Returns , Business - Management, Issues & Concerns , Estates, Gifts & TrustsBy Tax Services Department

I once had a wealthy client who was a private business owner that wanted to gift a vacation home to his children. Based on prior gifting, to transfer the property outright, he would have incurred a 40% gift tax rate on a portion of the value of the home because the fair market value was in excess of their remaining gift tax exemption.

As his advisor, we had discussed his long-term financial goals and created an Ohio limited liability company so the vacation home could be deeded into the LLC. Since the home was now an LLC asset, he had a qualified professional perform a valuation of the LLC.

Assigning several “discounts” for the value of the LLC , when he transferred the LLC ownership to the children, he was able to reduce the fair market value of the vacation home by using a 30% discount per the valuation. This simple planning allowed him to transfer the vacation home to his children without incurring any gift tax.

Needless to say, valuation discounts are a very important and significant component of estate planning. The two main discounts are lack of control and lack of marketability.

Lack of Control

Typically, when ownership of a family business is gifted to family members of a lower generation, the control stays with the older generation by the use of voting and non-voting stock. While the IRS originally maintained that valuation discounts for minority interests (lack of control) were not available, the IRS changed its position in 1993, in Revenue Ruling 93-12.

Lack of Marketability

In addition, a discount for a lack of marketability has been allowed because the Family Limited Partnership (FLP) units are not sold in the stock or other open market and are not easily valued. The lack of marketability discount is available because of the difficulty of selling “hard to value” assets. This opened the door for FLPs and family limited liability companies (FLLCs) to become very useful estate planning tools.

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (50)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (16)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (1)

- Digital Tax Payment (1)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (2)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (2)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (32)

- income (1)

- income tax (57)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (88)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (3)

- Ohio Department of Taxation (3)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Online Tax Payment (3)

- Operations (2)

- OPERS (1)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (53)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (12)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

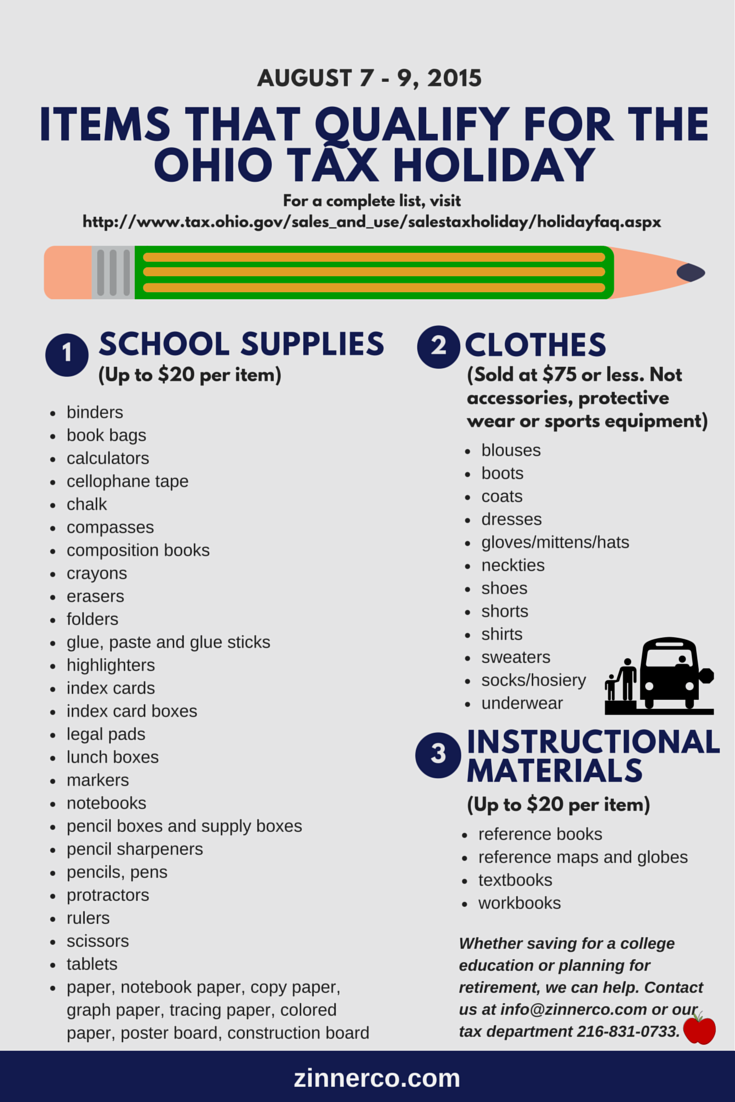

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (104)

- Taxes - Individual (117)

- Taxes - Planning, Rules and Returns (188)

- TechCred (1)

- technology (7)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (32)

- Zinner News (30)