With school just a few weeks away, many parents are in the thick of back-to-school shopping. The thought of spending countless hours in the stores and comparing sale prices online to save on pencils, paper, book bags and school clothes can be daunting.

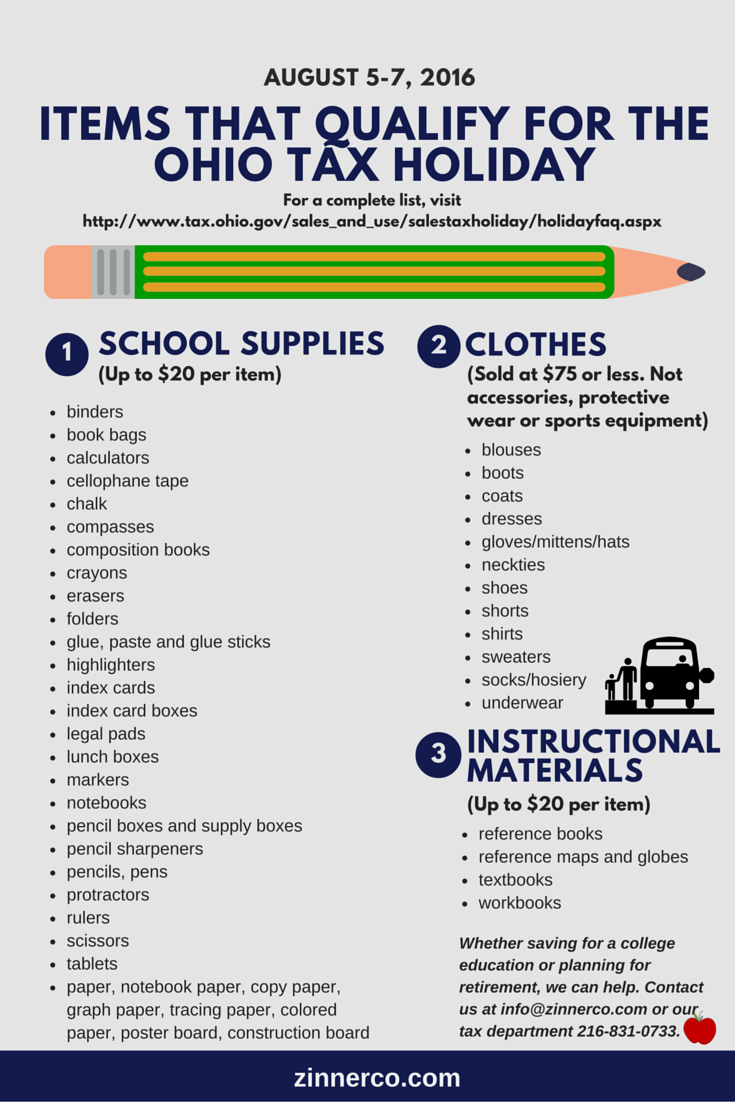

Fortunately, the State of Ohio has renewed legislation allowing for a second sales tax holiday, August 5 – 7, 2016. This sales tax holiday only applies to certain types of goods purchased from 12:01 am August 5th through 11:59 pm August 7th.

Back-to-School Sales Tax Holiday: What You Need to Know That Can Save You Dough

Zinner & Co. Tax Department education , Taxes - IndividualLooking for a gift to give after all those June weddings? How about some solid tax advice for the newlyweds?

Does your Organization Have a Conflict of Interest?

Chris Valponi, CPA non-profits , non-profit reporting , Chris ValponiMany not-for-profit organizations struggle to find qualified financial leaders for their boards. Often individuals possessing higher-level financial experience are asked to take on multiple roles, begging the question, “can a board member be both the treasurer and the chair of the audit committee”?

Can You Borrow Money from your Retirement Account ... and Should You?

Zinner & Co. Tax Department Taxes - Individual , Retirement Planning & IRAsSo you’ve finally had enough of the hype and are determined to score a pair of tickets to see “Hamilton” for Lin-Manuel Miranda’s final performance as the lead. Tickets selling through ticket brokering sites are going for outrageous prices, and you’re a bit short on cash. Should you embark on a personal revolution and loot your retirement accounts to go?

In a recent article, we addressed the exceptions to the early withdrawal penalty on IRA distributions taken prior to an individual reaching age 59 1/2. In such a case, the IRA distribution would still be subject to federal income tax and, potentially, state income tax, and would result in permanently removing those assets from the IRA, having a negative impact on the availability of future retirement income.

So, if you need a quick cash infusion and do not want to suffer the income tax ramification of an IRA distribution, what can you do? One option would be to take a loan from your retirement account. While an advisor may not typically recommend that an account owner borrow from their retirement account, a loan from one’s retirement can have both benefits and costs, as discussed below:

Summer Wedding? 6 Ways Getting Married Will Affect Your Taxes

Richard Huszai, CPA Taxes - Individual , Richard Huszai, CPA , IRSIt's here. Your summer wedding, long in the planning and preparation phase, has finally arrived. You've spent many months knee-deep in details, from the "will you marry me" or "I will's" to selecting the first song you dance to as husband and wife. You've bickered and resolved the guest list, swallowing your pride to allow crazy Aunt Alice to the reception even though you would rather not, and begrudgingly penning "and guest" to your best friends invitation even though you think their choice is less-than-stellar.

In the end, there is one person who many couples usually forget to include when budgeting for a wedding and finalizing the guest list: Uncle Sam.

Yes, there are tax issues that come along with getting married. Here are six basic tips courtesy of the IRS to help you on your road to wedded bliss:

Zinner & Co. was recently named an honoree of the 2016 Business Longevity Award by Smart Business Magazine. The firm, established in Cleveland in 1938 by Harry Zinner, is led by Managing Partner Robin Baum and partners Susan Krantz, Howard Kass, Gabe Adler and Brett Neate.

The award will be presented at an August 4th ceremony and will recognize Zinner & Co. in addition to only 44 other regional companies with at least 50 years in business. Honorees must have demonstrated their ability to adapt and evolve with changing times.

"We are thrilled to be named an award honoree and to share the distinction with such a prestigious group of companies," said Robin Baum, CPA, Managing Partner. Our approach to business growth and sustainability mirrors the same principles that we use when advising our clients; work strategically, with integrity, while never losing sight of the clients’ needs.”

The firm has evolved over the decades, becoming a true business partner that provides services beyond tax and accounting work. Specialty niche service areas not only span a variety of industries including real estate, manufacturing, professional services and not-for-profit, but also provide operational services including management consultancy, outsourced business services and planning and preparation for companies from start-up through succession.

This visionary method to business is part of what keeps the Beachwood-based firm on its successful track; the other part is the culture of giving, a tenet shared among all employees. Employees are active members of the region, whether serving on boards, volunteering, donating their time or talent, or spearheading a cause. “We believe growing our community is just as important as growing our business,” added Baum.

A Smart Business Magazine judging panel reviewed submitted essay's describing how companies remained viable over the decades and selected the recipients.

Using Your 990 to Tell Your Story

Chris Valponi, CPA non-profits , Estates, Gifts & Trusts , Chris ValponiMore and more third parties are looking at not-for-profit organizations’ IRS Form 990, so don’t just report; learn how you can use your 990 to tell your organization’s story.

Have you been notified by the IRS? You may want to think twice before responding to the call, email or letter.

The work of criminals knows no boundaries. Unfortunatley, this time of year brings another wave of antics to the forefront as the criminal will use various ploys to trick taxpayers into providing sensitive or personal identification information by posing as the IRS.

Aggressive and threatening phone calls by criminals impersonating IRS agents remain a major threat to taxpayers, but now the IRS is receiving new reports of scammers calling under the guise of verifying tax return information over the phone.

You may discover you made a mistake on your tax return. You can file an amended return if you need to fix an error. You can also amend your tax return to claim a tax credit or deduction.

Here are 10 tips from the IRS on amending your return:

Child Heading Off to College Soon? 3 Important Lessons About 529 Plan Withdrawals

DeAnna Alger, CPA education , 529 plan , income , income tax , withdrawls , college , tuitionMany of my clients have a child heading off to college in a month or two and have asked about 529 Plan withdrawals to help cover upcoming education expenses.

Contrary to what some may think, not all withdrawals are tax-free. Therefore, it is important to understand the basics of 529 plan distributions to avoid paying unwanted federal income tax. While it can be confusing, much like venturing into a college classroom, we’ve broken it down into three simple lessons.

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (50)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (16)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (1)

- Digital Tax Payment (1)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (2)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (2)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (32)

- income (1)

- income tax (57)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (88)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (3)

- Ohio Department of Taxation (3)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Online Tax Payment (3)

- Operations (2)

- OPERS (1)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (53)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (12)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (104)

- Taxes - Individual (117)

- Taxes - Planning, Rules and Returns (188)

- TechCred (1)

- technology (7)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (32)

- Zinner News (30)